Your step-by-step guide to making a Will

If making a Will feels a little overwhelming, we are here to help you at every step. We all know making a Will is something we should get around to but life often gets in the way.

Take a read through our guide and let's make a start today. Click below to jump to a relevant section or download your free PDF guide.

• Introduction: Why you should make a Will

• What type of Will do you need?

• How your current circumstances can affect your decision

• Who are the key people to consider when making your Will?

• Different ways to make your Will

• Registering and storing your Will

Introduction: Why you should make a Will

Whatever your age, if you have assets such as a house, savings or a business along with loved ones you would like to look after, it’s worth considering making a Will. It can also make the lives of those you leave behind a little less daunting at an extremely difficult time.

You may have worries over who would look after your children if you were no longer here. Or you may be concerned about how your family manage your care fee contributions in the future.

You may wish to maximise your tax allowances to ensure your family doesn’t pay more inheritance tax than they need to. All of this can be addressed by making a legally binding will.

In summary, a Will can:

• Name your Executors (the people who will distribute your estate

• Name your Beneficiaries (those who should benefit from your will)

• Appoint Guardians (to take care of your children)

• Include trusts to ensure bloodline inheritance

• Help to maximise tax allowances

• Aid in managing care fee contributions

• Ensure your business can live on after you have passed away

• Enable you to specify your funeral wishes

A valid Will is vital to ensure you and your family have control over the money, property and possessions you have worked so hard for, after you have passed away.

This video explains why you should make a Will:

A Will is a legal document that gives you the power to decide what should happen to your estate when you die. Your estate refers to your individual assets minus any liabilities.

Your Will clearly expresses your wishes as to how your property and possessions are to be distributed after your death. Some people choose to create what we would call a Simple Will, gifting all of their estate (called the residuary estate) rather than separating it into different amounts or items.

However, others wish to make gifts of property - for example, as a specific gift to a beneficiary (an outright gift) or provide only the right to use the property for a designated period before it is then passed to another specified beneficiary. This is often called a Right to Reside or a Life Interest.

In other cases, rather than specifying particular gifts of money - for example, £2,000 - it’s possible to specify the source of the account - i.e., “the contents of my Barclays account 1234567” - to help future proof the Will for changing circumstances. Gifts to charity can also be made within your Will and are an effective way of reducing Inheritance Tax liabilities.

You may wish to appoint Guardians to provide a loving home for your children but would like to appoint different people to look after your children’s financial interests i.e., Trustees.

The important thing to keep in mind is that your Will should be a completely personal and unique document for your individual circumstances. Also, do remember that your Will can be re-visited and changed as those individual circumstances change over time.

This video explains exactly what a will is:

What type of Will do you need?

Commonly you will have heard the terms “Single Will” and “Mirror Will”.

A Single Will

A Single Will is, as the name suggests, for a single person or a person with solely owned property and assets along with a specific set of wishes and beneficiaries.

A Mirror Will

A Mirror Will is usually two Wills that mirror each other and are often the result of a relationship between two people with the same shared assets, beneficiaries and wishes around what should happen to their estate. It ensures that the property is distributed on identical terms.

It’s worth noting that there is no such thing as a Joint Will. Each individual has their own Will which effectively mirrors the other.

Trusts

A Will can also contain Trusts to specify what should happen to certain assets and on what terms.

For example, you can include a Children’s Trust within your Will to specify at what age you wish for your children to inherit. You could also include a Business Trust to ensure your Business can continue and attract the appropriate tax allowances.

Many consider that Trusts are too complicated or believe they don’t have enough wealth for them to be relevant. The truth, however, is Trusts are woven into the fabric of many of our lives - a mortgage is a form of Trust, for example.

Put simply, you can consider a Trust (either within a Will or alongside a Will) as a safety deposit box in which to safely store your assets, protecting your estate and beneficiaries from the threats of divorce, sideways disinheritance, probate costs, remarriage, inheritance tax and more.

Many people make a Will assuming that a simple document is all that is needed. However, as you've read here, there is a great opportunity for you to ensure your wishes are ultimately fulfilled by making the correct provisions in your Will.

How your current circumstances can affect your decision?

Your personal circumstances should influence the content, structure and format of your Will. People often consider making a will after experiencing a trigger point within their life such as:

• Marriage

• Divorce

• Moving house

• Death of a family member

• Setting up a business

• Receiving an inheritance

• The birth of a child or grandchild

• A family member going into a care home

It’s also worth noting some common assumptions around inheritance when there is no Will in place. Without a Will it’s entirely possible that:

• Your spouse or partner will not automatically inherit all of your estate. Also, there is no such thing as ‘common law’ husband or wife, regardless of how long you’ve been together.

• Minor children could be taken into care whilst potential guardians are assessed and appointed.

• People outside of your immediate family are unlikely to benefit.

• Lengthy disputes and delays may be likely that prevent your preferred beneficiaries from benefitting as you would intend.

When you make a Will, you take control of these situations and ensure your wishes are fulfilled.

This video explains the different types of wills and what type of will you may need:

What about inheritance tax?

There are a number of implications on Inheritance Tax if someone does not have a will.

At its simplest, Inheritance Tax is the tax payable on an estate when a person dies if it exceeds a certain amount. The estate value is essentially the net value of everything a person owns i.e. all of the assets minus any expenses and debts.

Currently, inheritance tax is charged at 40% on the value of the estate above the threshold of £325,000 (subject to any exemptions or relief available at the time). Therefore, anything over the value of £325,000 is potentially taxable at 40%.

The threshold figure of £325,000 has not been increased for some time in line with house price inflation and is unlikely to be increased anytime soon. This means that a growing number of people will be facing tax liabilities and without careful planning, many will unknowingly fall into the inheritance tax net.

It’s really important that your Will and any Trusts are carefully structured to ensure tax allowances are maximised to ensure that beneficiaries receive as much as possible from your estate.

Who are the key people to consider when making a Will?

There are important decisions to make when creating your Will, not least the naming of the key people within your document.

Executors

These are the people who are charged with administrating and winding up your estate to make the distributions to your chosen beneficiaries.

Being an Executor is a demanding legal appointment and can involve large sums of money, so you should ensure the people you choose are happy to take up the role. You can appoint a family member, a beneficiary or close friend to act by themselves, jointly or as reserve Executors.

Whilst you do not have to appoint professional Executors, should your Will contain a Trust or be a little complicated, it could be worth having a professional as a reserve executor at least.

Beneficiaries

A beneficiary is a person who has been named to inherit in a Will. This person may be left property, land, money or possessions within a Will. A be a charitable cause or political party.

If you have disabled children who are likely to require specialist support, a Trust may be required to ensure your children’s standard of living is maintained. It's a good idea to seek professional advice on aspects such as this.

Guardians

You will only need to appoint guardians if you have have minor children (under the age of 18 years) and there is no person with parental responsibility alive at the date of your death.

You should choose your guardians carefully and ensure the people you appoint are willing to take on the role.

Trustees

A trustee is a person who takes responsibility for managing money or assets for the benefit of someone else.

Whilst an executor's role ends when the Will has been administered, the role of Trustee can extend for many years - for example, until a child is old enough to inherit. Executors and Trustees can be the same people or Trustees can be other family members, friends or professionals.

There are many different ways to make a Will, such as by a Professional Will Writer, a Lawyer or via charities and banks. You can also find online “DIY” will services.

The key consideration is to ensure any Will you make is legally valid in line with the requirements of the Wills Act 1837. A Will is a legal document, so needs to be written and signed correctly. If you decide to make your own Will, it’s best to seek advice first.

In addition, choose who draws up your Will wisely. Any firm should be regulated by one of the following organisations to ensure you, as a consumer, are protected:

- • Institute of Professional Will Writers

- • Institute of Paralegals

- • Society of Will Writers

- • Chartered Institute of Legal Executives

- • Solicitors Regulation Authority

You can conduct a search with each of these organisations to confirm that the professional you're considering using is an approved member.

This process will also ensure the firm you are dealing with is a specialist in their field because, after all, you wouldn't ask a GP to conduct brain surgery.

It’s important that when you make the decision to make a Will, the costs are made clear to you at the outset. As well as the cost of preparing your document, there may be additional costs such as Land Registry fees or other disbursements and your chosen professional will be able to clearly outline these to you.

Remember, you get what you pay for and if it seems too good to be true, it often is.

Here’s an outline of what you can expect to pay:

| Single Will | £150 to £250 |

| Mirror Wills | £250 to £400 |

| Will Trusts | £150 to £250 |

| Lasting Power of Attorney | £200 to £400 |

Keep in mind that this is one of the most important investments you will ever make. You are preserving your estate as a legacy for your loved ones to benefit from so it’s important that you get it right and choose your approach wisely.

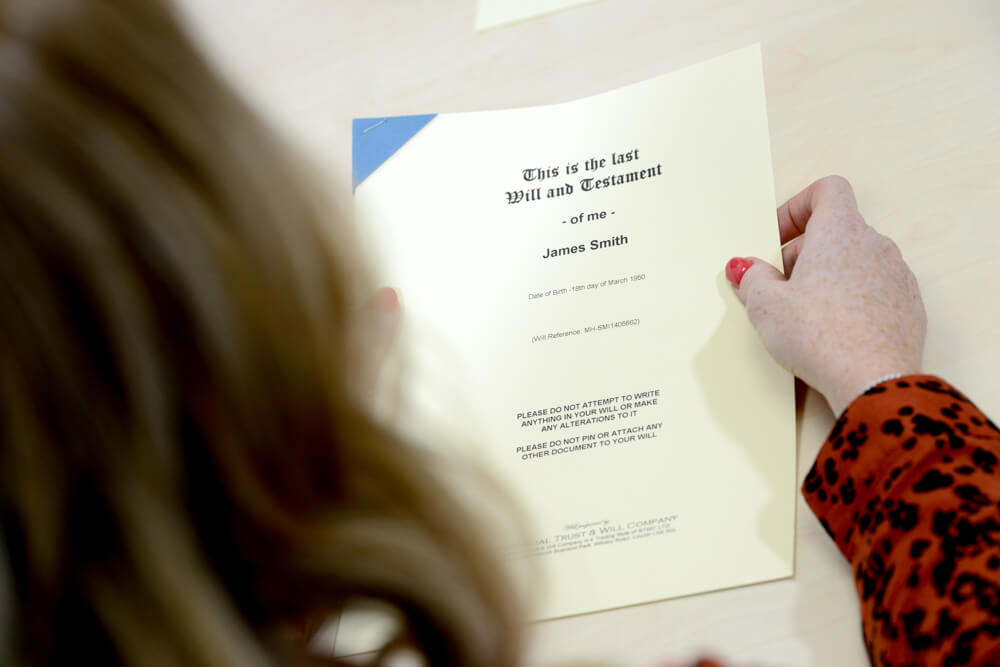

Registering and storing your Will

Once you’ve made your Will and had it correctly signed and witnessed, it’s important that you keep it in a safe place. Your Executors need to be able to find it and if it’s damaged in any way, it may not be acceptable to the Probate Registry.

In addition, if the original signed copy is lost you will be deemed as dying “intestate” i.e., without a Will, and the Probate Registry is unlikely to accept anything than the original signed copy.

At Beneficial Family Wills we provide a document safe storage solution, meaning any legal or important documents can be kept secure by us for future access, either by yourself or by a family member or executor as instructed by you. Ensuring the safe location of a document such as your Will is vital, if it were not in a safe place, in years to come it could be lost or someone could attempt to alter the document in some way. Either way, your wishes may not be carried out.

For an annual fee, this service not only gives you piece of mind, but also, you will be issued with a Safe Custody Certificate and Executor ID cards, a free registration with Certainty, the National Will Register plus a free update of your Will (one per annum) on a like for like basis should any of your circumstances change.

Something to keep in mind.

Keeping your Will up to date

In recent years, we've seen a rise in clients in wanting to make changes to their Will and get their affairs in order.

A Will should be thought of as a living document. As much as you try to ensure it is future proof when initially created, your Will should be reviewed at regular periods or at any point when there is a significant change to your personal circumstances.

There are a number of circumstances when you should consider reviewing your Will, such as:

• If someone named in your Will passes away.

• If you wish to change who inherits and is a beneficiary.

• You have children or the children reach legal age.

• You get married or divorced.

• You personally inherit various assets.

• You start a business.

• There is a significant change in your assets such as a second property.

However, it's important to note that a Will should never be physically altered or amended. This creates a risk that it will not be deemed acceptable by the Probate Registry as they may consider it has been fraudulently tampered with.

For example, if a name is crossed out and replaced with another name, this would raise suspicions as to whether it was amended by yourself or someone else.

A Codicil can be used to change a Will - it is a separate document that amends part of an existing Will and should be stored with a Will. Historically, when Wills were handwritten or typed with a typewriter, a Codicil saved considerable time as it meant that an entire document would not have to be re-drafted for a minor change.

However, there are a few risks to be aware of when making a Codicil:

• As the Codicil is an individual document, there is a risk that the Codicil may be separated from the Will itself. In this case, the change stipulated is lost and will not be implemented.

• The Codicil could be purposefully ignored or destroyed, with the unaltered Will subsequently standing.

• Where the change is perceived to be minor, there may be a temptation to make a ‘homemade’ Codicil. However, it should be remembered that a Codicil should still comply with the formalities of the Wills Act 1837.

• The Codicil could contradict wider aspects of the original Will, creating the potential for disputes later on.

Due to updated processes and procedures, it is often just as quick (and safer) to simply create a new Will with a clause that automatically revokes all former Wills.

Next steps

Deciding to make a will is a big step and a lot of careful decisions need to be made.

If you would like to speak to a member of our team we will be able to advise you, or alternatively you can download our Guide to Making your Will below.